The Higher Education Loans Board (HELB) has officially announced New Loan For Civil Servants across Kenya to apply for financial support through the Training Revolving Fund, aimed at helping them advance their education.

In an announcement made on Wednesday, August 12, 2025, HELB confirmed that the fund is open to civil servants working in Ministries, County Governments, the Teachers Service Commission (TSC), and the National Police Service.

According to HELB, the facility managed in partnership with the Ministry of Public Service is designed to enable eligible officers to pursue Certificate, Diploma, Higher National Diploma, Master’s, PhD, and Professional courses at accredited institutions in Kenya.

The loan carries no processing fees and offers a maximum of Ksh 500,000 per year. Beneficiaries will enjoy a repayment period of up to 72 months, managed through a salary check-off system, with an interest rate of just 4% per annum on a reducing balance.

Purpose of the Civil Servants Loan

The Civil Servants Training Revolving Fund is a joint initiative between the Higher Education Loans Board (HELB) and the Ministry of Public Service aimed at enhancing skills and capacity within Kenya’s public sector.

It is specifically designed for employees of the National Government, County Governments, the Teachers Service Commission (TSC), and the National Police Service, offering them an affordable way to further their education.

Through this fund, eligible civil servants can enroll in Certificate, Diploma, Higher National Diploma, Master’s, PhD, and Professional courses at accredited training institutions in Kenya. With flexible repayment terms and a low interest rate, the program encourages public servants to upgrade their qualifications without facing significant financial strain.

Who Can Apply for the Loan?

The Training Revolving Fund is open to a specific group of government employees who meet HELB eligibility requirements. Applicants must fall under one of the following categories:

- Civil servants currently employed in Ministries or County Governments.

- Teachers Service Commission (TSC) employees.

- National Police Service officers.

- Public servants with a clean HELB record and no pending loan defaults.

This targeted eligibility ensures that the fund directly benefits those serving in key public sector roles, helping them gain advanced qualifications while continuing their service.

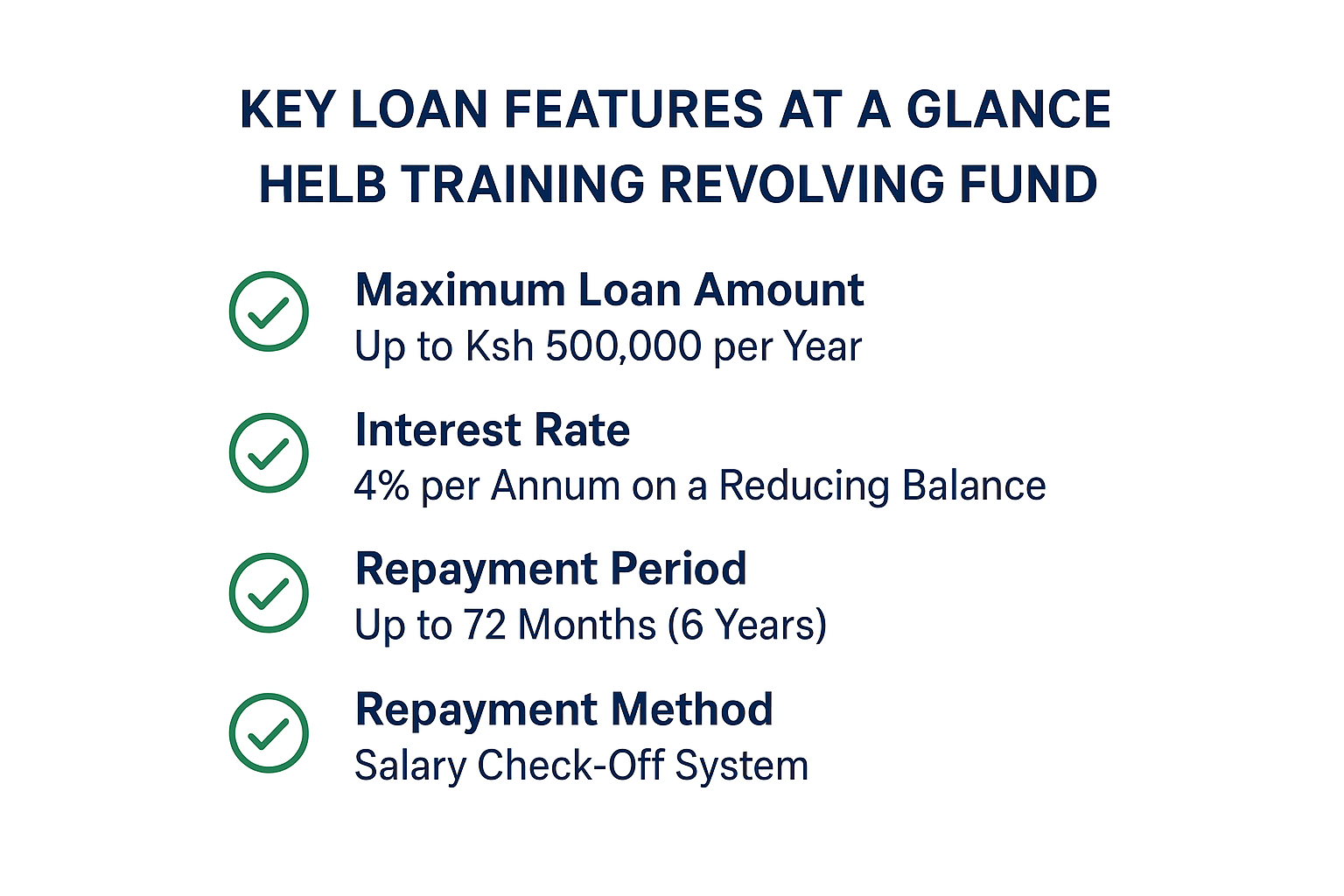

Key Loan Features at a Glance

The HELB Training Revolving Fund is tailored to meet the professional growth needs of civil servants, offering terms that are both flexible and affordable:

Maximum Loan Amount Up to Ksh 500,000 per Year

This high limit allows beneficiaries to comfortably cover tuition fees, examination fees, learning materials, and other study-related costs without having to seek additional financing.

Interest Rate 4% per Annum on a Reducing Balance

The interest is charged only on the outstanding balance after each repayment, meaning borrowers pay less over time compared to flat-rate interest loans.

Repayment Period Up to 72 Months (6 Years)

The extended repayment timeline makes monthly deductions smaller and more manageable, reducing the strain on the borrower’s salary.

Repayment Method Salary Check-Off System

Monthly installments are automatically deducted from the borrower’s salary by their employer, eliminating the risk of missed payments and helping maintain a clean credit record.

Processing Fee

HELB does not charge any processing or administrative fees, allowing applicants to access the full approved amount for their studies.

Eligible Courses Certificate to PhD and Professional Certifications

The fund supports a wide range of academic and professional qualifications, ensuring that civil servants can pursue any level of education relevant to their career growth.

With these features, the HELB Training Revolving Fund provides a rare opportunity for public servants to invest in their education with minimal financial pressure.

Eligibility Criteria for Applicants

To be considered for the HELB Training Revolving Fund, civil servants must meet specific conditions and provide the necessary documentation. These requirements ensure that the loan is issued to credible applicants who can successfully complete repayment.

Valid Admission Letter

Applicants must have an official admission letter from a recognized university or training institution in Kenya. This confirms that the loan will be used for an approved academic program.

Three Latest Certified Payslips

The payslips must be stamped and signed by the employer, showing a net salary above one-third of the basic pay. This requirement ensures the applicant can manage loan repayments without exceeding the legal salary deduction limit.

National ID and KRA PIN

Certified copies of the applicant’s National Identity Card and Kenya Revenue Authority (KRA) PIN are mandatory for identification and tax compliance purposes.

Two Civil Servant Guarantors

The applicant must secure two guarantors who are also employed within the civil service. Copies of their National IDs must be attached. Guarantors act as a safeguard for loan repayment in case of default.

Recent Coloured Passport-Size Photographs

Applicants must provide recent passport-size photos for identification in loan records and official documentation.

By fulfilling these criteria, applicants demonstrate both their eligibility and their capacity to handle the financial commitment of the loan.

Required Documents for Application

Applicants must compile and submit a complete set of documents when applying for the HELB Training Revolving Fund. These documents help verify eligibility and ensure smooth processing of the loan application.

Admission Letter

An official admission letter from an accredited Kenyan university or training institution, confirming acceptance into an eligible program.

Three Certified Recent Payslips

Payslips must be signed and stamped by the employer, reflecting the applicant’s most recent three months of salary. These serve as proof of income and repayment ability.

National Identification Cards

Certified copies of the applicant’s National ID and the IDs of both guarantors are required for identity verification.

KRA PIN Certificate

A valid Kenya Revenue Authority PIN certificate to confirm tax compliance.

Two Passport-Size Coloured Photographs

Recent, high-quality photos for official loan records and identification purposes.

Signed and Stamped Application Form

The completed application form must be signed by the applicant and stamped by their employer or relevant authority to validate employment status.

Providing all these documents in full and accurate form increases the likelihood of a faster loan approval.

Applying Online for New Loan For Civil Servants

Step 1: Create an Account on the HELB Portal

Visit the HELB Student Portal and register using your National ID and a valid email address. Activate your account via the link sent to your email.

Step 2: Complete Your Profile Information

Log in and fill in your personal details, residence information, educational background, and upload the required documents.

Step 3: Fill Out the Loan for Civil Servants Training Revolving Fund Form

Select the specific loan option, read and accept the terms and conditions, then enter details of your next of kin, employment, and guarantors.

Step 4: Submit, Sign, and Send Your Application Package

Submit the form online, print a copy, and have it signed and stamped by your employer. Attach all required documents, scan them into one PDF, and send to the official HELB email address for the fund.

Important Dates and Deadlines

Applications for the 2025/2026 academic year are officially open. Loan for Civil Servants who meet the eligibility criteria are strongly advised to submit their applications as early as possible to avoid the last-minute rush, which could lead to delays in processing.

While HELB has not yet released the final submission deadline, the official date will be announced on:

- The HELB website (www.helb.co.ke)

- HELB’s verified social media pages

- Through official public service communication channels

Early application is recommended, as it provides applicants with enough time to correct any errors, gather missing documents, and secure the required employer endorsements before the cut-off date.

| Stage | Timeline / Date | Notes |

| Application Opening | August 12, 2025 | HELB officially announced the Civil Servants Training Revolving Fund for 2025/2026. |

| Ongoing Application Period | August 2025 – Deadline TBA | Apply early to avoid last-minute rush and allow time for corrections. |

| Deadline Announcement | To Be Announced | Will be posted on HELB website, social media, and official public service channels. |

| Processing & Verification | Within a few weeks after submission | Includes document checks, employer verification, and guarantor confirmation. |

| Loan Award Notification | After successful verification | Sent via HELB portal account and registered email. |

| Loan Disbursement | Shortly after award notification | Funds paid directly to the learning institution. |

Repayment Terms and Interest Rate Explained

The HELB Training Revolving Fund offers one of the most flexible repayment plans for Loan for Civil Servants

- Repayment Period: Borrowers have up to 72 months (6 years) to repay the loan, making it manageable even for those with modest monthly incomes.

- Interest Rate: A 4% per annum interest rate is applied on a reducing balance, meaning interest is charged only on the remaining loan amount after each repayment, lowering the total cost over time.

- Repayment Method: Monthly deductions are made directly from the borrower’s salary via a check-off system, ensuring consistent payments without the risk of missed installments.

- Early Repayment: Borrowers can clear their loan ahead of schedule without any penalties, potentially saving more on interest.

This structure ensures that Loan for Civil Servants can further their education without facing overwhelming repayment pressure.

Common Mistakes to Avoid When Applying

To ensure a smooth application process, civil servants should avoid these common errors:

- Incomplete or Outdated Documents Submitting old payslips, expired ID copies, or missing guarantor details can delay approval.

- Incorrect Personal or Employment Details Typos in names, ID numbers, or employer info may cause verification failures.

- Unreliable Guarantors Providing guarantors who are unresponsive or unavailable can slow down the process.

- Late Application Submission Waiting until the last minute increases the risk of missing deadlines or needing corrections.

- Ignoring Terms & Conditions Not reading the loan terms can lead to misunderstandings about repayment schedules or eligibility.

- Poor Document Presentation Illegible scans, unclear photos, or un-stamped forms may result in rejection.

Tips for a Successful HELB Training Revolving Fund Application

Applying for the HELB Training Revolving Fund can be straightforward if you prepare well in advance. Follow these proven tips to improve your chances of quick approval and avoid unnecessary delays:

Prepare Certified and Up-to-Date Documents

Before starting your application, gather all the required documents including your admission letter, three latest payslips, National ID, KRA PIN, and coloured passport-size photos. Make sure these are certified by an authorized official and are the most recent versions. Incomplete or outdated paperwork is one of the most common reasons for application delays.

Select Reliable and Eligible Guarantors

You must provide details of two guarantors who are also employed in the civil service. Pick individuals who are easily contactable, cooperative, and willing to vouch for you. A guarantor who is unavailable or unresponsive can slow down the verification process.

Double Check All Your Details Before Submission

Accuracy is key when filling out the online HELB application form. Ensure that:

- Your name and ID details match exactly on all documents.

- Your employment and next-of-kin details are correct.

- All uploaded documents are clear and legible.

Even small mistakes like a typo in your email or ID number can cause processing issues.

Apply Early to Avoid Last-Minute Rush

While HELB will announce the official deadline on its website and social media platforms, don’t wait until the final days to apply. Submitting early gives you enough time to:

- Fix any application errors.

- Secure signatures and employer stamps.

- Replace any missing or rejected documents.

Keep a Digital Copy of Your Application

After submitting, save a scanned PDF copy of your signed and stamped form along with all attachments. This will help if HELB requests clarification or if you need to re-send your application package.

Pro Tip: Submitting a complete and error-free application the first time greatly increases your chances of fast approval and loan disbursement.

Why is a Game Changer for Loan Civil Servants

The HELB Training Revolving Fund is more than just a financial aid program, it is a career changing opportunity for Kenya’s civil servants. Many public sector employees dream of pursuing higher education or professional certification but are held back by high tuition costs and limited financing options.

Here’s why this loan stands out:

Removes Financial Barriers to Education

With a loan limit of up to Ksh 500,000 per year, eligible civil servants can comfortably cover tuition fees, learning materials, and related expenses without the stress of immediate repayment.

Affordable and Flexible Repayment

The 4% annual interest rate on a reducing balance and a repayment period of up to 72 months mean borrowers can spread the cost over several years without overwhelming their monthly budgets.

No Hidden or Upfront Costs

Unlike many loan facilities, this fund has no processing fees, ensuring that every shilling borrowed goes directly towards educational expenses.

Supports a Wide Range of Courses

From Certificate programs to PhDs and professional certifications, the fund supports learning at all levels, giving civil servants the flexibility to choose the academic path that best fits their career goals.

Bottom line: This loan not only makes education more accessible but also empowers Kenya’s public servants to enhance their skills, qualify for promotions, and contribute more effectively to public service delivery.

HELB Contact Information for Assistance

- Website: www.helb.co.ke

- Email: contactcentre@helb.co.ke

- Phone: +254 711 052000 / +254 204 920000

- Physical Office: Anniversary Towers, University Way, Nairobi

Benefits of the HELB Civil Servants Training Revolving Fund

- High Loan Amount Borrow up to Ksh 500,000 per year for tuition, exams, and study materials.

- Low Interest Rate Only 4% per annum on a reducing balance.

- Flexible Repayment Up to 72 months repayment period via salary check-off system.

- No Processing Fees Every shilling goes directly toward education costs.

- Helb Supports All Levels of Education From Certificate to PhD and professional courses.

- Early Repayment Allowed Pay off your loan faster without penalties.

- Career Advancement Opportunity Enhances qualifications, promotions, and professional skills.

Frequently Asked Questions

Who is eligible for the HELB Civil Servants Training Revolving Fund?

Civil servants working in Ministries, County Governments, the Teachers Service Commission (TSC), and the National Police Service are eligible. Applicants must have a valid admission letter from an accredited Kenyan institution, be in active employment, and meet the payslip and guarantor requirements.

What does the loan cover?

The loan mainly covers tuition fees, examination fees, and essential learning materials. It does not automatically include accommodation, transport, or personal expenses unless specified in the award letter.

How much can I borrow and at what interest rate?

You can borrow up to Ksh 500,000 per year at a 4% per annum interest rate on a reducing balance. Repayment is spread over a maximum of 72 months (6 years).

How is the loan repaid?

Repayments are made through a salary check-off system, where deductions are automatically made from your salary each month. Early repayment is allowed with no penalties.

What documents are required when applying?

You must provide a valid admission letter, three recent certified payslips, National ID, KRA PIN, two civil servant guarantors’ IDs, recent passport-size photos, and a signed application form stamped by your employer.

How do I apply for the loan?

Register on the HELB Student Portal, complete your profile, fill in the Civil Servants Training Revolving Fund form, submit online, print, sign, get employer’s stamp, attach required documents, and send as one PDF to HELB.

Can I reapply or renew the loan?

Yes. If your course lasts more than one academic year, you must renew your application annually via the HELB portal before the new academic year begins.

What happens if I default on repayment?

Defaults attract penalties and possible CRB listing. HELB may recover funds from your guarantors or take legal action. Staying on track with repayments protects your credit record and avoids extra costs.

Conclusion

The HELB Civil Servants Training Revolving Fund is a powerful tool for career growth in Kenya’s public sector. It not only removes financial barriers to higher education but also offers low interest rates, flexible repayment terms, and zero processing fees.

Whether you’re looking to upgrade your qualifications for a promotion, gain specialized skills, or pursue advanced studies, this loan gives you the financial breathing room to focus on your education without worrying about immediate costs.

By applying early, preparing complete documents, and following the application process carefully, civil servants can unlock new opportunities, boost their professional credentials, and make a lasting impact in public service.