The Kenyan government recently introduced a new university fee structure, affecting thousands of students nationwide. As education costs rise, many learners are now worried about covering daily expenses. This change has pushed the Higher Education Loans Board (HELB) to revise its support model. Their new update specifically targets upkeep loans for students facing financial challenges.

HELB’s response comes at a critical time, especially for students from vulnerable households. Upkeep loans help cover essential needs like food, rent, and transportation during study. Without this support, many may struggle to stay enrolled or complete their education. Understanding these updates is now more important than ever for planning ahead.

What is the update on HELB loan applications?

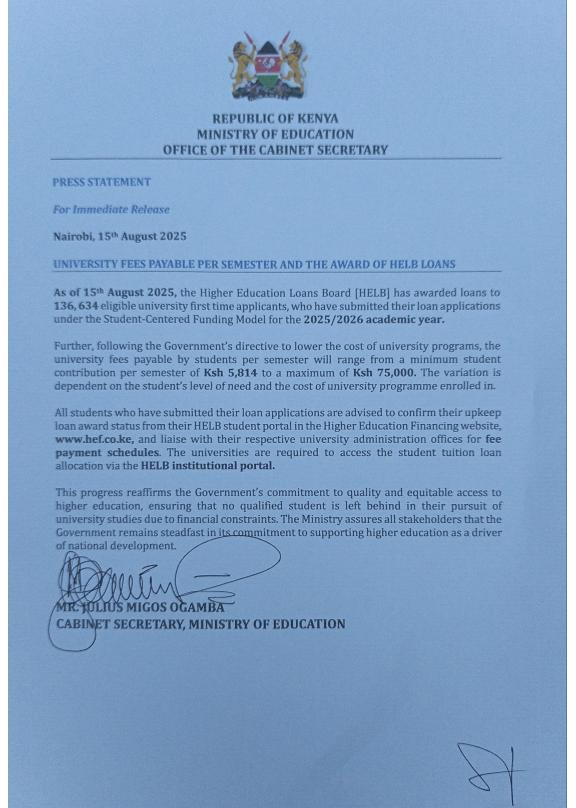

The Education Cabinet Secretary, Julius Migos Ogamba, has instructed students who applied for HELB loans to check and confirm their loan allocations.

- Students should log in to their HELB student portal on the Higher Education Financing (HEF) website – www.hef.co.ke.

- They need to confirm the status of their upkeep loan award (the portion sent directly to students).

- After confirming, students must also coordinate with their university administration offices to know their fee payment schedules.

- Universities, on the other hand, are required to access and manage the student tuition loan allocation through the HELB institutional portal.

👉 In short:

Students must confirm their loan award on the HELB portal, while universities will handle tuition allocations through the institutional portal.

As of 15th August 2025, HELB had awarded loans to 136,634 eligible first-time applicants. Additionally, university fees will now range from Ksh 5,814 to Ksh 75,000, in line with the Government’s directive to lower the cost of academic programs. See poster below for more details.

🔄 Difference Between HELB Upkeep Loan and Government Scholarship

| Feature | HELB Upkeep Loan | Government Scholarship |

| Purpose | Covers daily expenses (meals, rent, transport) | Covers part or all of tuition fees |

| Repayment | Must be repaid after graduation | Non-repayable (free funding) |

| Disbursement Method | Sent directly to student’s bank/M-Pesa | Paid directly to the university |

| Eligibility | Based on financial need (via MTI) | Based on financial need (via MTI) |

| Amount Received | Varies by need (e.g., Ksh 15,000–60,000/year) | Up to 100% of tuition fees for vulnerable |

| Use of Funds | For upkeep: food, transport, accommodation | For tuition only |

| Application Platform | HELB Portal | KUCCPS + HELB (joint model) |

Overview of the New University Fee Structure

The new Higher Education Funding Model splits university costs among the government, HELB, and students’ families. It replaces the old fixed system where all students received equal support regardless of need. Under the new model, funding depends on how financially needy each student is. This system ensures that government resources go to those who need them most.

Students are now assessed using the Means Testing Instrument (MTI), which places them into four categories: vulnerable, extremely needy, needy, and less needy. Those most in need get full scholarships and HELB loans, while others receive partial aid or none at all. As a result, many families are now expected to contribute more towards education. This shift makes HELB upkeep loans even more vital for student survival and academic success.

The government announced new university fees, and HELB has issued an update for upkeep loan applications. Full details in comments.

Photo: Ministry of Education/HELB (X)

💼 HELB Upkeep Loan Adjustments Explained

Following the rise in university fees, HELB has updated how upkeep loans are allocated. The new model gives priority to vulnerable and extremely needy students identified through the MTI system. Students with higher financial need receive larger upkeep loan amounts to help cover living expenses. Those considered less needy may receive smaller loans or no upkeep support at all.

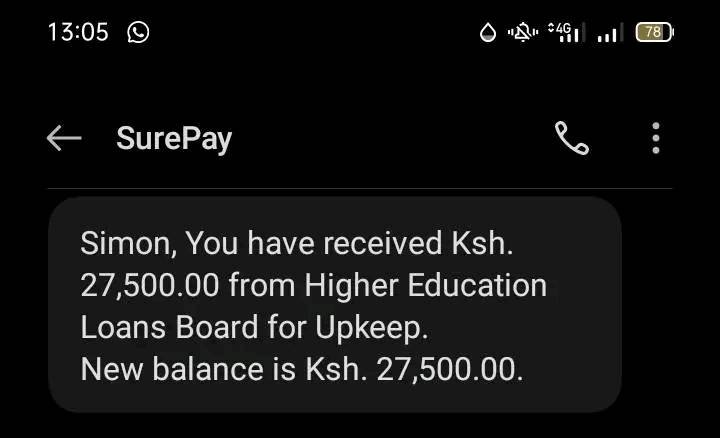

Additionally, HELB has refined its disbursement method to ensure faster and more transparent payments. Upkeep funds are now sent directly to students’ bank or M-Pesa accounts, improving accessibility. This change helps students manage food, transport, and accommodation expenses throughout the semester. The adjustments aim to reduce student dropouts caused by financial hardship.

How HELB Determines Needy or Extremely Needy Students

HELB uses a system called the Means Testing Instrument (MTI) to assess student financial need. This tool collects data on income, household size, secondary school type, and parental status. It also considers whether the student comes from a marginalized region or vulnerable background. All these factors are combined to give a need based score for loan allocation.

Based on this score, students are placed in four groups: vulnerable, extremely needy, needy, and less needy. Those in the vulnerable category are prioritized for full scholarships and higher upkeep loans. The MTI ensures that support is helb distributed fairly across different economic backgrounds. It’s a key part of the government’s effort to make higher education more inclusive.

Who Qualifies for the Updated Upkeep Loans?

To qualify for HELB’s updated upkeep loan, students must be enrolled in a public university or TVET institution. First-year students applying through the KUCCPS placement system are automatically assessed for eligibility using the MTI. Those identified as vulnerable, extremely needy, or needy will receive upkeep loan support. Continuing students under previous models may still receive upkeep, depending on availability of funds.

Applicants must also submit accurate personal and family data on the HELB portal. This includes parental income, school history, and dependent details for need verification. Students must have a valid national ID, a bank or M-Pesa account, and be enrolled in a recognized program. Accurate information is essential for successful evaluation and timely disbursement.

Changes in Upkeep Loan Amounts

HELB has introduced variable upkeep loan amounts based on each student’s financial need level. Under the new model, extremely needy students can receive up to Ksh 60,000 per year for upkeep. Students in the needy or less needy categories may receive lower amounts like Ksh 45,000, Ksh 30,000, or even none. This structure ensures that limited funds reach those who truly need support.

The new system is more targeted but also introduces significant differences in what students receive. Two students in the same class may now receive very different loan amounts, depending on their MTI scores. This has raised concerns among students who fall just outside the top need categories. Still, the aim is to maximize fairness and support vulnerable learners first.

Breakdown of a HELB Loan (Tuition + Upkeep)

To help students understand how the loan is structured, here’s a sample HELB loan breakdown. It shows how the total amount is split between tuition support and upkeep disbursement:

| Loan Component | Amount (Ksh) |

| Tuition Support | 50,000 |

| Upkeep Loan | 45,000 |

| Total Loan Amount | 95,000 |

The tuition portion is paid directly to the university, while the upkeep loan is sent to the student’s bank or mobile money account. The exact amounts may vary depending on institutional fees and individual need category.

First Year vs. Continuing Students: Who is Affected?

The new HELB upkeep loan model primarily affects first-year students admitted through KUCCPS in the 2023/2024 academic year and beyond. These students are automatically evaluated under the new Means Testing Instrument. Their tuition and upkeep support is now fully guided by this need-based model. This shift marks a major departure from the previous one-size-fits-all approach.

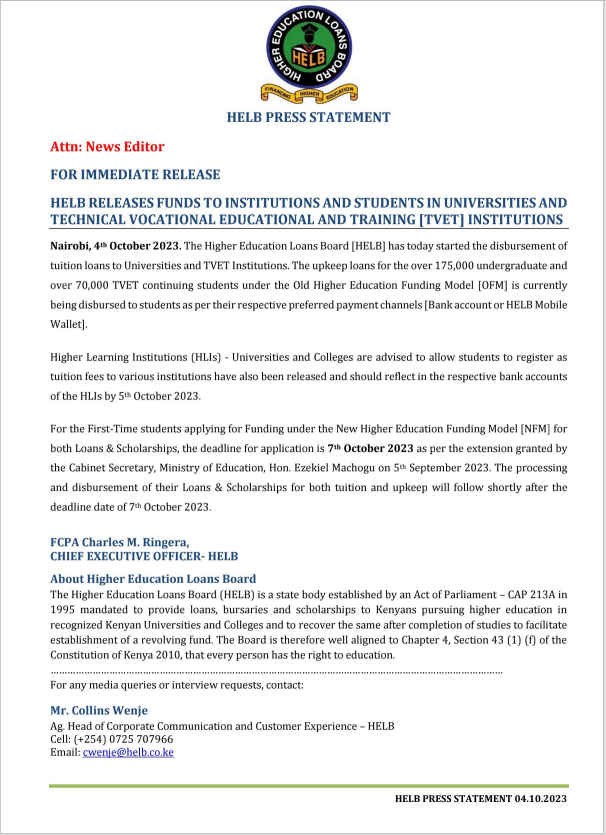

Continuing students (from earlier intakes) are still funded under the old HELB model. However, they may still experience delays or reduced disbursements due to budget constraints or policy changes. HELB has promised not to cut off their funding but has acknowledged challenges in keeping up with rising costs. All students, regardless of intake year, are advised to regularly update their details on the HELB portal.

How the New Fee and Loan Model Affects TVET Students

TVET students are also included in the new higher education funding model. Like university students, they are assessed using the MTI and may receive a combination of scholarships and HELB loans. However, the amount awarded to TVET students is often lower due to shorter course durations and reduced fee structures. Still, upkeep loans remain critical for these learners to manage daily expenses.

TVET students are advised to apply through KUCCPS and complete the HELB loan application early. They are also required to register through their institutions and keep their contact and bank details updated. The support provided helps bridge the gap between education and technical skills development. HELB continues to play a key role in expanding access to vocational education across Kenya.

Impact on Families and Working Parents

The new university funding model has placed increased pressure on families, especially those with multiple children in higher education. Under the old model, government subsidies were more predictable and evenly spread among students. Now, many middle- and lower-middle-income families are expected to contribute more directly. This change has raised concerns among parents who are already financially stretched.

Working parents now face the challenge of balancing daily expenses with rising university costs. Those who do not fall under the “extremely needy” category receive limited or no financial support. This forces them to turn to personal loans, savings, or fundraising to cover education expenses. HELB’s upkeep loan is now a lifeline for many students who cannot depend fully on their families.

How to Apply for the Updated HELB Upkeep Loan

To apply for the HELB upkeep loan, students must first visit the HELB portal. Start by creating an account or logging in if you already have one. Next, fill out the loan application form carefully and provide all required personal and academic details. Be sure to select the first-time or subsequent loan option depending on your situation.

After completing the form, submit the Means Testing Instrument (MTI) and upload all necessary documents. These include your ID, admission letter, passport photo, and academic transcripts. Print the completed form, have it signed and stamped by the relevant authorities, and keep a copy for yourself. Submit the form either online or through your institution’s financial office.

Common Mistakes to Avoid in the HELB Loan Application

Many students face delays or rejections due to avoidable mistakes during the HELB application process. One of the most common errors is submitting incomplete forms or leaving required fields blank. Others include forgetting to sign the printed form or using outdated academic or financial information. Mistakes like these may cause disqualification or long processing delays.

Another major issue is incorrect bank or M-Pesa details, which can block or misdirect disbursements. Always double-check your account number and ensure the account is in your name. Also, avoid applying at the last minute when system traffic is high. Applying early and carefully is the best way to ensure your loan is approved and disbursed on time.

Students Appeal for More Upkeep Support?

Yes, students who believe they were underfunded can request a loan review or appeal. To do this, write an official appeal letter explaining your financial situation and why you need more support. You must include relevant documents such as medical reports, guardianship letters, or death certificates. The appeal can be submitted through your university or directly to HELB offices.

HELB reviews each appeal on a case-by-case basis, depending on available funds and supporting evidence. While approval isn’t guaranteed, well-documented cases often receive additional support. Students are encouraged to act quickly after receiving their loan award notice. Late appeals or appeals without proof may not be considered.

How to Update Bank Details for Upkeep Loan Disbursement

If you change your bank or M-Pesa account, it’s essential to update those details on the HELB portal. Login to your HELB account, go to the profile or bank details section, and make the necessary changes. Ensure that the account you provide is active and registered under your name. Using someone else’s account could result in delayed or blocked payments.

It’s also wise to use accounts from banks that have previously worked with HELB to avoid issues. Once updated, double-check your entries to avoid typographical errors. HELB verifies bank details before disbursement, so providing accurate and valid information is crucial. Students are advised to make these updates well before the disbursement cycle begins.

Key Dates and Deadlines for Application

HELB usually opens loan application windows shortly after KUCCPS placements are finalized. For the 2025/2026 academic year, the deadline for first-time undergraduate and TVET loan applications is 31 August 2025. Students must complete their MTI forms, upload required documents, and submit everything before this date. Delays or incomplete applications may result in missing out on funding.

HELB strongly encourages early application to avoid system congestion and last-minute errors. Many students face technical problems when applying close to the deadline due to high traffic. Submitting early also gives you time to fix any mistakes in your application. Always keep checking HELB’s website or social media pages for real-time updates.

Upkeep Loans Be Disbursed

HELB disburses funds after reviewing and verifying all applications, typically a few weeks after the deadline. Tuition fees are sent directly to the university’s bank account, ensuring the student remains registered. Upkeep loans, on the other hand, are sent to the student’s personal bank or M-Pesa account for daily use.

Disbursement usually happens in batches, so not all students receive funds on the same day. First-time applicants may face longer delays due to identity and document verification. Returning students typically receive funds sooner, assuming their profiles are updated. You can track your disbursement status via the HELB app or portal.

HELB App: Apply, Track, and Check Loan Status on Mobile

The HELB Mobile App makes it easier for students to manage their loans on the go. Available on Android and iOS, the app allows you to apply for loans, track your application, and get instant notifications. You can also check your disbursement status, download statements, and update bank details directly from the app.

The app also sends alerts for upcoming deadlines, missing documents, and loan approvals. This helps reduce missed communications, especially for students without consistent email access. It’s a practical tool for staying on top of your application and repayment journey. Ensure your phone number and ID details are accurate when registering on the app.

Student Reactions and Campus Concerns

Many students have welcomed HELB’s efforts to support the most vulnerable, but concerns still remain. On campuses and social media, students are voicing worries about delayed disbursements, unequal funding, and confusion about eligibility. Some say the MTI classification is unclear and doesn’t always reflect real financial need. Others worry that those barely outside the vulnerable category are left unsupported.

Student unions have urged HELB and the government to increase clarity, speed up communication, and expand funding limits. Some student leaders are even calling for more flexible appeal processes. While the updates are a step forward, many students feel that the rollout of the new model has caused more questions than answers. The need for better guidance and faster disbursement is a common request across campuses.

University Feedback and Administrative Views

Universities are working to adjust their internal processes to align with the new funding model. Financial aid officers report a surge in inquiries from confused students about how the new MTI system affects them. Some institutions have set up special help desks to guide first-year students through the application process. However, administrative staff also admit the system is still evolving.

University management teams are calling on HELB and the Ministry of Education to improve coordination and communication. Delays in funding can impact registration, housing, and academic calendars. Institutions are also seeking clarity on how to manage students caught between the old and new systems. Many believe more joint planning is needed to ensure a smoother transition.

Latest Statements from the Ministry of Education on HELB Loans

The Ministry of Education has reaffirmed its support for the new Higher Education Funding Model. In a recent public address, the CS of Education assured students that no one would be denied access to university due to financial limitations. The ministry confirmed that funding would be distributed fairly based on MTI data. This aims to protect the most vulnerable students during the transition.

HELB has today started disbursement of funds to continuing students and Higher Learning Institutions. Here’s a press statement on the payment status

Additionally, the government has increased HELB’s allocation in the national budget to support the new model. Officials have encouraged students to apply early and provide honest, accurate information. There are ongoing consultations between HELB, KUCCPS, and universities to improve the rollout. The ministry also warned against misinformation and urged students to rely on official communication channels.

HELB Promise to Needy Students

HELB has consistently emphasized its commitment to supporting needy and vulnerable students across Kenya. In official updates, HELB has stated, “No eligible student will be left behind due to lack of finances.” The board assures students that funds are being distributed transparently and equitably using the MTI system. HELB also confirmed that upkeep loans will be prioritized for those in need.

Furthermore, HELB is working to enhance its disbursement systems and improve application turnaround time. The organization has pledged to make the funding process more efficient, accessible, and inclusive. They continue to educate students through webinars, campus tours, and social media engagement. The goal is to ensure every deserving student can pursue their studies without financial interruption.

FAQs

Is upkeep included in all HELB loans?

No. Upkeep is only provided based on your financial need level. Less needy students may receive partial or no upkeep support.

Can I get a HELB loan if I already have a scholarship?

Yes. But your loan amount may be adjusted based on how much the scholarship covers.

How do I check my disbursement status?

Login to the HELB portal or use the HELB mobile app for real-time updates.

Can I appeal my loan award?

Yes. Submit a written appeal with supporting documents (e.g., medical, death, or unemployment evidence).

How much upkeep can I receive?

Up to Ksh 60,000 per year for extremely needy students; less for others depending on MTI.

Conclusion

As Kenya transitions into a more targeted and needs-based higher education funding model, the role of HELB has become more crucial than ever. With rising tuition costs and a heavier burden placed on families, upkeep loans are no longer optional; they are essential. HELB’s adjustments reflect a genuine effort to ensure that vulnerable students are not left behind in this new system.

By understanding how the Means Testing Instrument works, staying ahead of deadlines, and applying correctly, students can maximize their chances of receiving support. Whether you’re a first-year applicant or a continuing student, staying informed is key. HELB’s commitment to fairness, transparency, and accessibility shows that while the model has changed, the mission remains the same to make higher education possible for all.