The Higher Education Loans Board (HELB) has been instrumental in promoting access to higher education in Kenya. While government-backed loans remain its foundation, HELB now increasingly administers HELB Partner Funds specialized financing programs developed in partnership with public and private institutions. These funds are designed to bridge financial gaps for students in critical fields such as healthcare, maritime studies, communication, and technical training.

In this guide, we’ll break down what HELB Partner Funds are, how they work, and highlight the most impactful funding options currently available through the HELB portal.

📘 What Are HELB Partner Funds?

HELB Partner Funds are specialized student financing programs administered by the Higher Education Loans Board (HELB) in collaboration with corporate partners, government agencies, donors, and educational institutions. These funds are designed to support students in targeted sectors where skill development is essential for national growth.

Depending on the partner’s goals and funding model, these funds are offered in three main formats:

- 🎓 Scholarships Fully funded awards with no repayment obligations

- 💸 Revolving Loan Schemes Low-interest education loans that are repaid and reused to support more students

- 🌀 Hybrid Models A mix of scholarship and loan components, tailored to specific student needs

Each partner fund is created with a clear purpose, such as:

- Enhancing the healthcare workforce

- Supporting civil servant capacity building

- Financing students in technical and vocational institutions

- Promoting maritime, legal, and communication sector training

These funds are managed with full transparency and governance oversight, using HELB’s robust digital systems and national disbursement network.

Why Partner with HELB?

Partnering with the Higher Education Loans Board (HELB) offers institutions, donors, and employers a secure, impactful, and transparent way to invest in Kenya’s future workforce. Through its well-established systems and national reach, HELB helps partners implement targeted education financing programs with high accountability.

Here are the key benefits of partnering with HELB

Access to Extensive Student Data

HELB maintains a comprehensive database of students across various levels and disciplines including TVET institutions, medical colleges, universities, and law schools. This enables partners to precisely target financial support to the most relevant and deserving beneficiaries.

Nationwide Infrastructure

With a presence in 28 Huduma Centres, a fully functional Contact Centre, and a dedicated HELB Portal, the Board offers nationwide accessibility for both applicants and fund administrators.

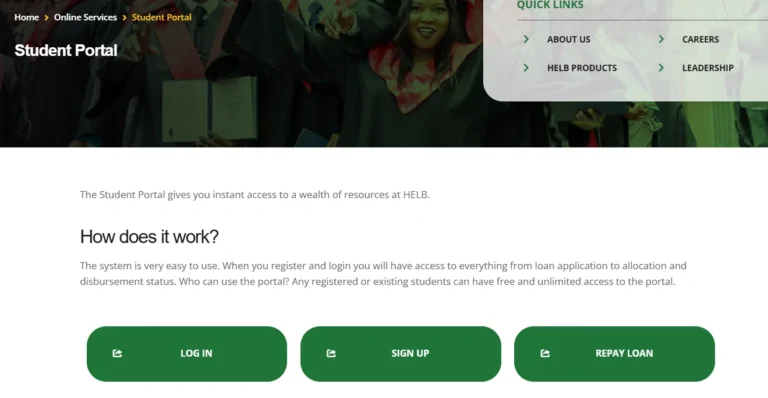

Fully Digital Application & Disbursement System

From application to selection and disbursement, the entire process is managed through HELB’s digital systems. This ensures speed, efficiency, and complete transparency reducing the risk of manual errors or fund mismanagement.

Strong Risk Mitigation Framework

HELB’s repayment system is legally backed and integrated with national institutions like KRA, NHIF, and NSSF for efficient loan recovery. Additionally, credit life insurance safeguards both the borrower and the fund in case of unforeseen events.

Transparent Governance Structure

Each Partner Fund is governed by a Technical Working Group (TWG) composed of HELB representatives and the partner institution. The TWG ensures proper oversight, quarterly reporting, and adherence to the fund’s objectives.

Support in Resource Mobilization

HELB doesn’t just manage funds it helps partners grow them. Services include donor engagement, proposal development, and fundraising strategy design to ensure the long-term sustainability of the financing program.

HELB Partner Funds in Kenya

Here’s a complete list and brief explanation of the active HELB Partner Funds in Kenya

Kenya Institute of Professional Studies (KIPS) Training Revolving Fund

This fund supports students enrolled at KIPS by offering low-interest loans to cover tuition and other training expenses. It helps learners in diploma and certificate programs access quality technical and business education.

Kenya Institute of Mass Communication (KIMC) Training Revolving Fund

Designed for students at KIMC, this fund provides financial assistance to those pursuing studies in media, film production, journalism, and communication. It promotes growth in Kenya’s creative and communication sectors.

Beacon of Hope Training Revolving Scheme

A revolving loan fund for students studying at Beacon Technical Training Institute, especially in technical and vocational courses. It supports youth empowerment and job readiness through skill development.

Catherine McAuley Nursing School Loan Application

This fund supports nursing students at Catherine McAuley School of Nursing by offering education loans to cover tuition, accommodation, and practical training needs, particularly for those from underserved communities.

Water, Sanitation & Irrigation Training Revolving Scheme

This specialized fund provides financial support for students studying water-related engineering, sanitation, and irrigation technologies. It helps build capacity for Kenya’s water and environmental sectors.

KASNEB Foundation Scheme

Offers loans for students pursuing professional qualifications through KASNEB (e.g., CPA, CS, CIFA). It covers tuition, registration, and exam fees for learners at KASNEB-accredited institutions.

Advocates Benevolent Association (ABA) Fund

A legal sector fund offering financial support to law students and junior advocates. It may cover tuition at institutions like the Kenya School of Law, exam preparation, or bar exam fees.

Kenya School of Law Tuition Loan

This fund directly supports students attending the Kenya School of Law for the Advocates Training Programme (ATP). It ensures students can complete their final step before becoming licensed lawyers in Kenya.

Maritime Education and Training Scheme (METS)

Created in partnership with the Kenya Maritime Authority (KMA), this fund supports students taking maritime courses such as STCW, navigation, and marine engineering. It prepares learners for seafaring and maritime logistics careers.

Kenya School of Integrated Medicine (KISM)

Supports students at KISM pursuing diplomas in community health, nutrition, and medical laboratory technology. The fund helps build Kenya’s capacity in preventive and community based healthcare.

Community Health Promotion Fund

This fund offers loans to students in public health, nursing, and health promotion programs particularly at North Coast Medical Training College. It focuses on grassroots-level healthcare development.

Bar Examination Loan (BEL)

Specifically designed to help candidates sitting for the Kenya School of Law Bar Exams, this loan covers exam registration fees and prep costs for law graduates seeking admission to the bar.

Eastlands College of Technology Fund

A revolving fund supporting students at Eastlands College of Technology in Nairobi. It focuses on electrical, mechanical, ICT, and other technical training programs for disadvantaged youth.

Digital Divide Data (DDD) Staff Education Fund

This fund supports employees of Digital Divide Data who wish to pursue further education. It encourages continuous professional growth among staff through financial aid for diplomas and degrees.

AIC Kijabe Hospital Fund

This healthcare-focused fund supports students and staff in nursing and clinical officer training at Kijabe Hospital. It plays a vital role in strengthening rural healthcare delivery in Kenya.

Civil Servants Training Revolving Fund (TRF)

A government-backed fund that enables civil servants including county staff and uniformed officers to upgrade their skills through academic or short-term training. It supports professional development in the public sector.

HELB Afya Elimu Fund (AEF)

A public-private partnership between HELB, USAID, and the Ministry of Health, this flagship fund supports medical trainees (especially at KMTC) with affordable loans. It has already helped over 48,000 students and is a key component of Kenya’s Universal Health Coverage (UHC) strategy.

How It All Comes Together

The implementation of a HELB Partner Funds is not a casual process it follows a highly structured, transparent, and strategic model that ensures every shilling is accounted for and every eligible student is served fairly. Here’s a closer look at how the full partnership lifecycle works:

Proposal & Onboarding

The journey begins when a potential partner which could be a government agency (like the Ministry of Health), an NGO (like USAID), a corporate foundation (like KCB Foundation), or a learning institution (like KMTC) submits a formal proposal to HELB.

This proposal includes:

- The fund’s goal (e.g., to support medical training)

- The target audience (e.g., diploma-level nursing students)

- Fund size and structure (scholarship, loan, or hybrid)

- Eligibility criteria (academic performance, financial need, course type)

Once the proposal is reviewed and approved, the onboarding process begins. HELB provides technical guidance to ensure the fund is aligned with legal and operational standards.

Contract Signing & Technical Working Group (TWG) Formation

To protect both HELB and the partner’s interests, a service-level agreement (SLA) is signed. This legal contract outlines:

- Roles and responsibilities of both parties

- Financial terms and conditions

- Disbursement procedures

- Monitoring and evaluation requirements

Simultaneously, a Technical Working Group (TWG) is formed. This group includes representatives from HELB and the partner organization. The TWG:

- Oversees fund operations

- Reviews performance reports

- Approves disbursement cycles

- Advises on fund policy changes

This ensures governance and transparency at every level.

Fund Transfer & System Setup

The approved funds are then transferred to HELB’s central account. HELB configures the new fund into its digital systems which includes:

- Creating a new application module in the HELB Student Portal

- Activating internal monitoring and audit controls

- Updating disbursement workflows and accounting systems

This step ensures that the partner fund is fully functional and ready for public access.

Application & Disbursement

HELB then announces the fund typically through its website, social media, universities, and Huduma Centres. Eligible students are invited to apply via the HELB Student Portal, where they:

- Register/log in

- Fill out a customized application form

- Upload required documents (ID, admission letters, fee statements, etc.)

Applications are automatically scored using HELB’s built-in system based on financial need, academic merit, and partner criteria.

Successful applicants receive:

- A Loan Award Letter

- Disbursement directly to their institutions (tuition) and/or mobile wallets (upkeep)

All transactions are traceable, and applicants are notified via SMS/email.

Repayment & Sustainability

For loan based HELB Partner Funds, beneficiaries are required to start repayment after completing their studies and the grace period lapses (usually 1 year). HELB recovers these funds through:

- Payroll deductions

- Self-pay options via M-Pesa or bank

- Integration with KRA, NHIF, and NSSF for employer tracing

Revolving fund repayments are recycled to support new applicants, creating sustainable impact over time without exhausting the original capital.

Credit life insurance is also applied in most cases, ensuring the loan is written off in case of death or permanent disability.

Governance, Monitoring & Reporting

The TWG continues to meet quarterly to:

- Review fund utilization reports

- Assess disbursement progress

- Audit repayments and defaults

- Recommend improvements based on performance data

Partners receive comprehensive reports covering:

- Number of applicants and awardees

- Demographics (age, region, gender)

- Amount disbursed

- Repayment progress

- Fund balance and sustainability forecast

This level of transparency builds trust and long-term partnerships.

Summary of the Process

| Step | Description |

| Proposal | Partner submits funding proposal and eligibility plan |

| Contract | SLA signed; TWG formed for governance |

| Fund Setup | Digital system integration and fund activation |

| Applications | Students apply online; selection automated |

| Disbursement | Loans/scholarships paid to institutions/students |

| Repayment | Recovered through legal and payroll systems |

| Oversight | TWG monitors, reports, and improves fund |

This process ensures that HELB Partner Funds remain efficient, accountable, and impactful, while giving both students and partners a transparent, reliable experience.

Additional HELB Partner Funds FAQs (Info Not in Main Article)

What is a Technical Working Group (TWG) and who is part of it?

A Technical Working Group (TWG) is a committee formed for each Partner Fund. It includes representatives from HELB and the partnering organization. The group ensures proper governance, oversees fund operations, reviews reports, and ensures funds are used according to the agreed terms.

How long does it take to set up a new Partner Fund with HELB?

Setting up a new fund typically takes a few weeks to months depending on:

- The complexity of the fund

- Legal agreement finalization

- Fund transfer and digital system setup

HELB provides full onboarding support throughout the process.

Can private institutions create a Partner Fund with HELB?

Yes. Both public and private institutions, NGOs, county governments, and even private companies can partner with HELB to create a fund. The institution must meet minimum legal and operational requirements to ensure transparency and accountability.

What is the minimum or maximum amount a Partner Fund can offer per student?

There’s no universal limit. Each Partner Fund sets its own funding ceiling per beneficiary based on:

- Fund size

- Training costs

- Number of target students

Some funds cover full tuition, others include upkeep or exam fees.

What happens if a student changes institutions mid-course?

If a student changes institutions, they must notify HELB immediately. Continuation of funding depends on:

- Whether the new institution is supported by the same Partner Fund

- Whether the course of study remains eligible

The TWG may review and approve continuation on a case-by-case basis.

What is the grace period for HELB Partner Funds loan repayment?

Most revolving funds offer a 12-month grace period after graduation. This allows students time to secure employment before beginning repayment. Details are included in each student’s loan agreement.

Conclusion

The HELB Partner Funds initiative stands as a transformative model in Kenya’s education financing landscape. By combining public resources with private and institutional partnerships, HELB has created a powerful ecosystem that supports learners in critical sectors from healthcare and maritime to law, media, and technical training.

Whether you’re a student seeking financial aid or an organization looking to invest in Kenya’s human capital, HELB offers a transparent, efficient, and scalable platform to drive impact.

With more than 17 active partner funds, thousands of students are now able to pursue their academic dreams, gain professional qualifications, and contribute to national development. As repayment and governance mechanisms keep these funds sustainable, the impact continues year after year.