If you are a student, you should be aware that study expenses extend beyond tuition fees. Especially in Kenya, pursuing higher education means bearing the burden of expenses for books, transportation, accommodation, food, and university fees.

Keeping up with all these expenses can be overwhelming, as having a full-time job with your studies is not an option. Here is where the Higher Education Loans Board (HELB) steps in.

HELB provides financial assistance in the form of scholarships and easy loans to the students. One of the many components of HELB, the upkeep HELB loan covers all the expenses other than the tuition fee. In this guide, you will learn the process of applying for and checking the status of your HELB loan.

What is Upkeep in HELB Loan?

An element of the Higher Education Financing (HEF) package given to Kenyan students to help with living expenditures, including food and residence, is known as the upkeep HELB loan.

The loan money is transferred into the student’s personal bank account or mobile wallet, as opposed to tuition costs, which are transferred straight to the university. It is a component of a new funding model intended to give qualified students who are seeking higher education financial assistance so they can cover expenses other than tuition.

Tuition Fee vs The Upkeep Loan

A tuition loan is intended exclusively for school bills like tuition fees, while an upkeep loan covers living expenses like housing, food, and everyday essentials.

The primary difference between the two is that while upkeep loans cover the more general expenses of living as a student, tuition loans cover the actual cost of classes and teaching.

Eligibility Criteria

If you are a Kenyan citizen and you are primarily a student placed by KUCCPS (The Kenya Universities and Colleges Central Placement Service) into a public university or approved TVET (Technical and Vocational Education and Training) under the new funding model of the Ministry of Education, then yes, you are eligible for the upkeep HELB loan.

You must provide accurate and complete personal and family details via the HELB portal. The Means Testing Instrument (MTI), which automatically evaluates first-year students placed by KUCCPS, determines which students are vulnerable, highly dependent, or in need of upkeep assistance.

Additionally, you must have a current bank or M Pesa account and a valid national ID. It is essential to submit accurate information in order to guarantee appropriate review and prompt fund distribution.

How Much Can You Get From the Upkeep Loan?

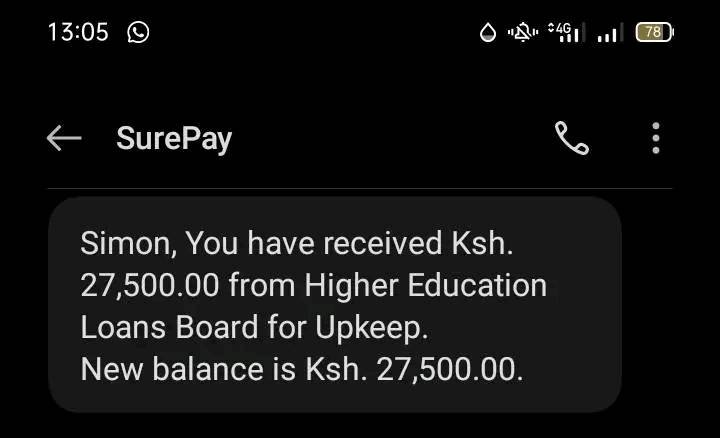

Based on your financial necessity as determined by the MTI, a total of KES 40,000 to KES 60,000 in loans is given out annually. You will get two payouts, one every semester. That amounts to KES 20,000 to KES 30,000 every semester before you enter your bank or M-PESA.

The university receives a normal tuition payment of KES 4,000 per semester. The remaining amount (about KES 36,000 to KES 56,000 annually) is used as an upkeep loan.

How to Apply For the Upkeep HELB Loan

If this is your first time applying for the upkeep HELB loan, you need to follow these simple steps. This guide will help you apply more smoothly and easily.

- Create Account

To use the Student Portal, go to the HELB website, then click “register” to create an account.

- Enter ID Number

Enter your ID number and make sure you have your national ID. If you don’t have a national ID, provide your KCSE Index number.

- Registration

Click “register” after entering a working email address and password.

- Log In

Once your account is successfully created and activated, check your inbox or spam/junk folder and log in.

- Verify Code

To receive a verification code, enter a working phone number. To obtain a new verification code if the current one expires, click the “resend” button.

- Update Biodata

Update your biodata and fill out your profile.

- Give Consent

Give consent to share your personal information.

- Terms & Conditions

To agree to the conditions of use, check the box after reading the permission form to learn why sharing your personal information is necessary.

- Save Personal Information

Enter your personal information and click “Save” to proceed.

- Send Application

Once everything is completed, send in your upkeep HELB loan application.

- Guarantor Information

Revise your guarantor information as per the requirement.

- Enter Bank or Mobile Details

Enter loan payment details in the designated boxes (bank or mobile payment).

- Recheck

Once everything is completed, recheck all the given details and send in your loan application.

By following these 13 simple steps, you won’t miss anything important while submitting your loan application.

Checklist of the Required Documents

Remembering all the documents that are required for the application process can be exhausting. Let us help you here. We have created a checklist of all the required documents so you don’t miss anything important during the process.

- Your legitimate phone number and email address.

- Your KCPE (Kenya Certificate of Primary Education) and KCSE (Kenya Certificate of Secondary Education) index numbers and the year of examination.

- Your passport-size photo in jpeg, jpg, or png.

- A copy of your National Identity Card or Maisha Card in PDF.

- A valid M-PESA number or bank account information (registered under your name and ID number)Parents’ registered phone number and national identification card.

- A copy of your birth certificate in PDF format (if applying as a juvenile)

- The parent’s death certificate, if deceased.

- IDs and registered phone numbers of two guarantors (who may be parents)

- A copy of the sponsorship letter (in PDF format) if the student is being sponsored for secondary education.

If you have completed your documents according to this checklist, your process will be smooth and stress free.

What You Should Not Do While Applying For Upkeep HELB Loan?

Generally, students make some silly mistakes when they are submitting the upkeep HELB loan application. These minor mistakes can cause delay or even rejection of your application. Here is a “not to do” list during the process to prevent rejection or delay in fund transfers.

- Never pay for upkeep using someone else’s M-pesa or bank account information.

- A person’s National Identification Number (ID) should never be used.

- Never give out your Student Portal password to anyone.

- Never give out your M-PESA, bank, mobile app, or USSD PIN to anybody.

- Avoid being scammed! Applications and processing fees for loans and scholarships are free.

- Do not make any mistakes while filling out the application. Be extra conscious.

- Do not forget to get the papers signed by your dean if required.

Take care of these minor things, and you will get there without being stressed.

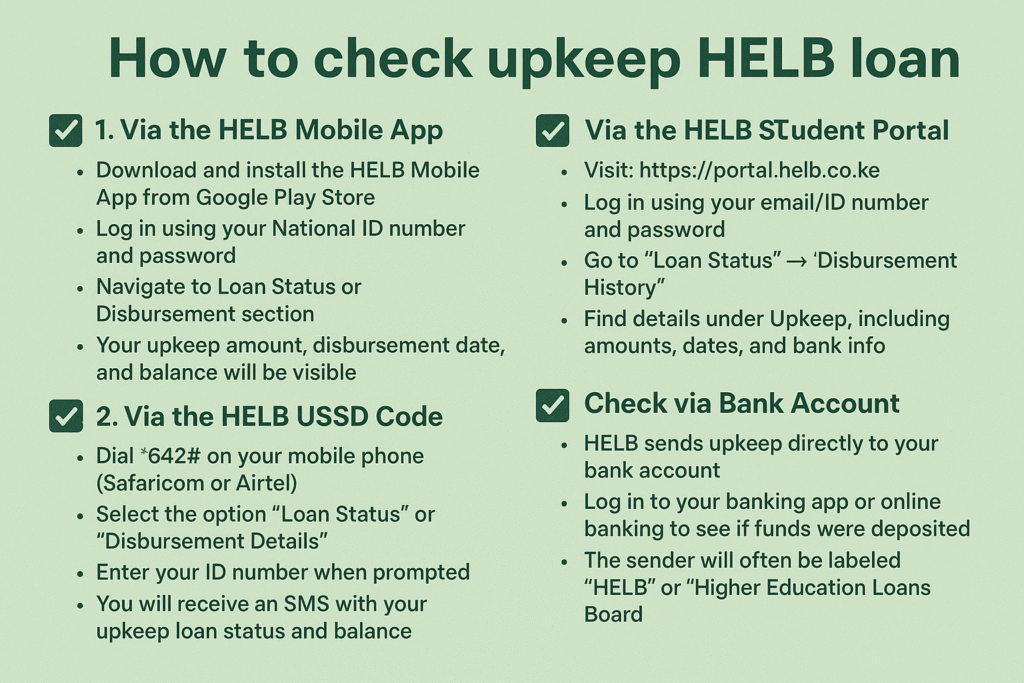

How to check upkeep Helb loan

There are various ways through which you can stay updated about your loan application.

- Through HELB Portal: You can track your application status through HELB portal. Simply go to the HELB website, click on the Loanees portal link, and then finally log in to your account to check your application status, loan balance, and other details.

- Through Your Phone: Dial *642# on your phone to get the USSD service and follow the on-screen instructions. An easy and convenient way to stay updated.

- Through Mobile App: You can also download the HELB app on your phone to get instant updates related to your application and fund.

- Through Contact Center: HELB has a direct contact center to get instant assistance. You can call 0711 052 000 and get updates.

You can also email HELB at https://www.helb.co.ke/self-serve/ and get answers to your queries.

It’s better to stay ahead and updated than to face unnecessary delay in your funds.

When Do You Get the Upkeep HELB Fund?

After confirmation from your university, HELB upkeep funds are distributed at the start of the semester to students in their personal accounts, frequently through M-PESA.

You should verify your application progress on the HELB Student Portal to make sure your institution has verified your information, as the precise timeframe depends on the disbursement schedule and certification by your university or TVET institution.

HELB funds are released twice a year, at the start of each semester. However, for faster processing and a higher probability of receiving the loan, applicants are advised to begin the HELB loan application one month in advance. The funds are released by the Board no earlier than two weeks before the start of the semester.

Reasons Behind the Upkeep Loan Delay

Even if you filled out the application without any mistakes, there can still be a possible delay in the disbursement of your funds. There can be multiple reasons behind these delays. Let’s discuss a few of them.

HELB is unable to send upkeep funds if your name, branch code, or bank account number is incorrect. Prior to the dates of payout, always double-check your financial details on the HELB portal.

Also, if you made a mistake while giving your personal information, like ID, phone number, or email ID, your funds can be delayed.

Funding for HELB is contingent upon government budget releases. Loan and scholarship payments can be delayed if Treasury budget disbursements are delayed.

What You Can Track

- Loan Application Status

Check whether your HELB application is pending, approved, or rejected. - Disbursement Status

View when your tuition and upkeep funds were released. Note that upkeep payments are sent directly to your personal bank account.

Repayment Status

Monitor your repayment progress. You can also apply for a loan clearance certificate after settling your loan.

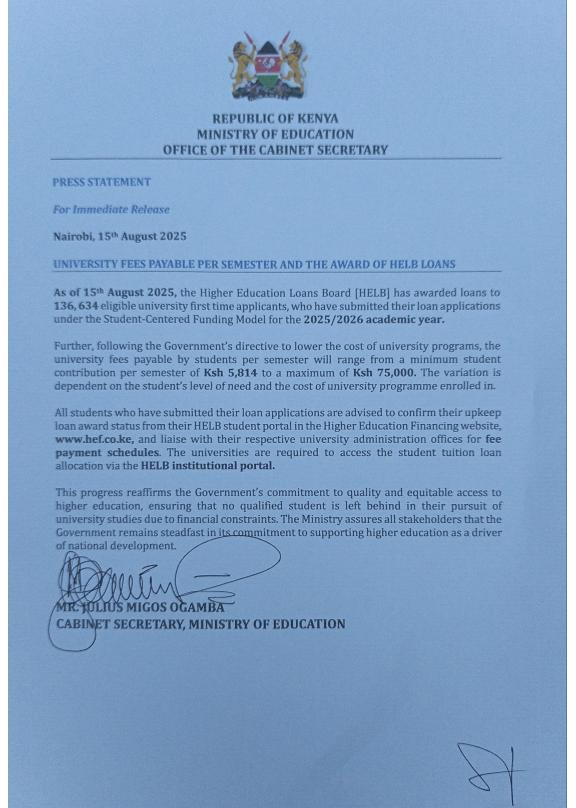

update on HELB loan applications

Students who applied for HELB loans are encouraged to check their loan status on the official HELB Student Portal at www.hef.co.ke. This allows them to confirm whether their upkeep loan has been approved and view the amount allocated. Universities have also been directed to access tuition loan allocations via the HELB Institutional Portal, streamlining disbursement and reducing delays. These updates aim to ensure timely financial support, promote equitable access to education, and help students plan for tuition and living expenses more effectively, in line with the Ministry of Education’s goal to support a skilled and educated workforce.

👉 In short:

Students must confirm their loan award on the HELB portal, while universities will handle tuition allocations through the institutional portal.

As of 15th August 2025, HELB had awarded loans to 136,634 eligible first-time applicants. Additionally, university fees will now range from Ksh 5,814 to Ksh 75,000, in line with the Government’s directive to lower the cost of academic programs. See poster below for more details.

Difference Between HELB Upkeep Loan and Government Scholarship

| Feature | HELB Upkeep Loan | Government Scholarship |

| Purpose | Covers daily expenses (meals, rent, transport) | Covers part or all of tuition fees |

| Repayment | Must be repaid after graduation | Non-repayable (free funding) |

| Disbursement Method | Sent directly to student’s bank/M-Pesa | Paid directly to the university |

| Eligibility | Based on financial need (via MTI) | Based on financial need (via MTI) |

| Amount Received | Varies by need (e.g., Ksh 15,000–60,000/year) | Up to 100% of tuition fees for vulnerable |

| Use of Funds | For upkeep: food, transport, accommodation | For tuition only |

| Application Platform | HELB Portal | KUCCPS + HELB (joint model) |

Smart Budgeting Tips

Once you get your funds in your bank account or E-Pesa, you need to do smart spending so you can get enough benefit from this fund. Here are some smart budgeting tips that can be helpful to stay on budget.

- Make a basic budget plan. As soon as you receive your loan, write down your fixed expenses (food, transportation, and rent/hostel) and set aside funds for them.

- Prioritize over wants. Prioritize necessities like food, lodging, and literature over fun or extravagance.

- Avoid impulse spending. Don’t utilize loan payments for impulsive purchases, parties, or pricey electronics.

- Cook instead of eating out. Compared to ordering takeaway every day, cooking at home or with roommates can save a significant amount of money.

- Use student savings. Benefit from student-only savings on events, books, software, and transportation.

- Set up a small amount; even KES 500–1000 a month can assist in building up an emergency fund for unforeseen expenses.

- Monitor your expenditures to keep track of where your money is going. Use an Excel sheet, notebook, or apps like M-Pesa statements. On-time bill payment.

- Penalties may apply for late rent, utility, or internet payments. You can prevent this by creating a budget.

- Limit your debt and borrowing. Refrain from taking out additional credit or loans to “top up” your maintenance funds since this could eventually become too much to handle.

Because HELB disbursements are semester-based, plan for the semester rather than just the month. This will help you stretch your money and prevent you from running out of money in the middle.

New University Fee Structure

The New University Fee Structure under Kenya’s Higher Education Funding Model introduces a needs-based approach where university costs are shared between the government, HELB, and students’ families. Unlike the previous model that offered equal support to all, the new system uses a Means Testing Instrument (MTI) to categorize students as vulnerable, extremely needy, needy, or less needy.

Those with the highest financial need receive full government scholarships and HELB loans, while others get partial or no funding, depending on their MTI classification. As families are now expected to shoulder more of the cost, HELB upkeep loans have become increasingly important in helping students manage living expenses and continue their education without interruption.

The government announced new university fees, and HELB has issued an update for upkeep loan applications. Full details in comments.

Photo: Ministry of Education/HELB (X)

HELB Upkeep Loan Adjustments Explained

In response to rising university fees, HELB has adjusted its upkeep loan allocations to prioritize students based on financial need, as determined by the Means Testing Instrument (MTI). This tool evaluates factors like household income, family size, school type, parental status, and whether a student comes from a marginalized background, assigning each applicant a need based score.

Students are then categorized as vulnerable, extremely needy, needy, or less needy, with those in the top two categories receiving larger upkeep loans to cover essential living costs such as food, transport, and accommodation. To improve access and transparency, HELB now disburses funds directly to students’ bank or M-Pesa accounts, reducing delays and helping prevent financial dropouts. These changes aim to ensure that students from the most disadvantaged backgrounds receive the greatest support, making higher education more equitable and accessible.

The Repayment of the Upkeep HELB Loan

The loan has an annual ledger of Kshs. 1,000 and an interest rate of 4%. After studies are finished, repayment begins within a year, or for as long as the Board determines to recall the loan. The maximum repayment period for the loan is 120 months.

You can repay your upkeep HELB through the following methods.

- Once you are employed, your employer may submit a portion of your monthly salary to HELB directly.

- For self-employed graduates or freelancers, the HELB M-Pesa Paybill number makes it simple to make repayments.

- HELB permits loan repayments via specified bank accounts as well.

- The HELB portal offers a number of payment options for individuals who would rather conduct business online.

Whether you work for yourself, in the gig economy, or in the official sector, these alternatives are made to make repayment as easy as possible. In addition to preventing fines, timely repayment maintains your credit rating for future lending chances.

Breakdown of a HELB Loan (Tuition + Upkeep)

To help students understand how the loan is structured, here’s a sample HELB loan breakdown. It shows how the total amount is split between tuition support and upkeep disbursement:

| Loan Component | Amount (Ksh) |

| Tuition Support | 50,000 |

| Upkeep Loan | 45,000 |

| Total Loan Amount | 95,000 |

The tuition portion is paid directly to the university, while the upkeep loan is sent to the student’s bank or mobile money account. The exact amounts may vary depending on institutional fees and individual need category.

First Year vs. Continuing Students: Who is Affected?

The new HELB upkeep loan model primarily affects first-year students admitted through KUCCPS in the 2023/2024 academic year and beyond. These students are automatically evaluated under the new Means Testing Instrument. Their tuition and upkeep support is now fully guided by this need based model. This shift marks a major departure from the previous one size fits all approach.

Continuing students (from earlier intakes) are still funded under the old HELB model. However, they may still experience delays or reduced disbursements due to budget constraints or policy changes. HELB has promised not to cut off their funding but has acknowledged challenges in keeping up with rising costs. All students, regardless of intake year, are advised to regularly update their details on the HELB portal.

Common Mistakes to Avoid in the HELB Loan Application

Many students face delays or rejections due to avoidable mistakes during the HELB application process. One of the most common errors is submitting incomplete forms or leaving required fields blank. Others include forgetting to sign the printed form or using outdated academic or financial information. Mistakes like these may cause disqualification or long processing delays.

Another major issue is incorrect bank or M-Pesa details, which can block or misdirect disbursements. Always double-check your account number and ensure the account is in your name. Also, avoid applying at the last minute when system traffic is high. Applying early and carefully is the best way to ensure your loan is approved and disbursed on time.

Students Appeal for More Upkeep Support?

Yes, students who believe they were underfunded can request a loan review or appeal. To do this, write an official appeal letter explaining your financial situation and why you need more support. You must include relevant documents such as medical reports, guardianship letters, or death certificates. The appeal can be submitted through your university or directly to HELB offices.

HELB reviews each appeal on a case-by-case basis, depending on available funds and supporting evidence. While approval isn’t guaranteed, well-documented cases often receive additional support. Students are encouraged to act quickly after receiving their loan award notice. Late appeals or appeals without proof may not be considered.

Benefits of The Upkeep HELB Loan

The upkeep HELB loan is beneficial in so many ways; for example:

- The upkeep HELB loan promotes equal opportunity for higher education.

- It reduces the financial stress among students.

- It supports students from low-income families.

- It improves the academic focus of students.

- It raises the overall standard of education in the country.

FAQS

How to redeem upkeep funds from HELB?

To redeem your upkeep funds, ensure you have an active bank account or M-Pesa number linked to your HELB profile. Once HELB disburses funds, the amount is sent directly to your account. You’ll receive an SMS confirmation from HELB or your bank. If using M-Pesa, ensure you’ve selected M-Pesa as your disbursement option in the HELB portal.

How do I check my HELB upkeep balance?

You can check your upkeep balance by:

- Logging into the HELB Student Portal at www.hef.co.ke

- Using the HELB Mobile App (available on Android)

- Dialing *USSD code 642# on your phone (Safaricom users only)

These platforms allow you to view your loan status, disbursement history, and remaining balance.

What is the upkeep for Band 4?

Band 4 represents students classified as less needy under the Means Testing Instrument (MTI). They may receive minimal or no upkeep support, depending on HELB’s budget and funding policies. The exact amount is usually lower compared to what vulnerable or extremely needy students receive.

Has HELB disbursed upkeep money?

Yes, HELB regularly disburses upkeep funds at the start of each semester, once institutions confirm student enrollment. You can confirm your personal disbursement status by logging into the HELB portal, using the mobile app, or dialling *642#.

What is the maximum amount for student loans?

The maximum HELB loan amount varies depending on the program and financial need. For university students, the maximum can go up to KSh 60,000 per year, which includes both tuition and upkeep components. TVET students may receive up to KSh 40,000 to 50,000 annually, depending on eligibility.

What is the minimum HELB repayment amount?

The minimum monthly repayment for HELB loans is KSh 1,500, although this can vary based on the total loan amount and agreed upon repayment plan. Repayment begins one year after graduation or upon gaining employment whichever comes first.

How do student loans affect credit?

HELB loans affect your credit history just like any other loan. Timely repayments help build a positive credit score, while defaulting or delaying payment may result in being blacklisted by CRBs (Credit Reference Bureaus) in Kenya. A poor credit score can limit your ability to secure future loans or financial services.

Conclusion

As Kenya transitions into a more targeted and needs-based higher education funding model, the role of HELB has become more crucial than ever. With rising tuition costs and a heavier burden placed on families, upkeep loans are no longer optional; they are essential. HELB’s adjustments reflect a genuine effort to ensure that vulnerable students are not left behind in this new system.

By understanding how the Means Testing Instrument works, staying ahead of deadlines, and applying correctly, students can maximize their chances of receiving support. Whether you’re a first-year applicant or a continuing student, staying informed is key. HELB’s commitment to fairness, transparency, and accessibility shows that while the model has changed, the mission remains the same to make higher education possible for all.